News

Private Mortgage loans Imply More Liberty

Having times when banking companies are not able otherwise unwilling to lend currency for the mortgage, private loan providers is actually an alternative option for borrowers. In reality, a personal financial otherwise mortgage is the common option, based on your position.

Individual Mortgage loans Discussed

An exclusive financial try a preliminary-term mortgage acquired out of a private lender such an individual, organization, or a small group of buyers. These businesses can make their very own statutes and constraints when it comes to credit money and sometimes don’t use the same criteria while the banking institutions whenever giving mortgage applications.

As to why Look for a private Home loan?

Personal mortgage loans are often sought after by the borrowers that have bruised borrowing from the bank that are not qualified to receive a traditional mortgage toward finest pricing and terms and conditions out of a bank otherwise financial institution.

Individual lenders in addition to generally speaking offer a whole lot more easy installment terminology and so are so much more flexible within their terms if you are capital the loan.

There are various private loan providers into the Ottawa that will offer you a mortgage, despite a poor credit records. While the institutional lenders was stricter about their home loan underwriting, in addition to exactly who capable provide to help you, a lot of people that have bruised credit don’t realize they may be able rating a mortgage.

The fresh new rigid legislation having organization lenders are especially inconvenient for all of us with non-conventional incomes including provider experts, seasonal experts, and you can notice-working people.

Having private lenders, a home loan may be within your arrive at, no matter your history. Chris Allard offers possibilities, and private lenders simply take of several issues into consideration, also bizarre earnings and private record, just your credit rating.

Of many private loan providers range from the chance out-of a lesser rate immediately following your have demostrated a confident cost records, and may let rebuild and you may change your borrowing, delivering you a better rates just a few years in the mortgage!

In terms of bringing accepted to have a private financial, this course of action appears a little while various other as compared to old-fashioned bank mortgages.

Having old-fashioned home-based mortgage loans regarding a lender and other major financial intuition, lenders commonly heavily weighing things just like your credit score and you will borrowing history, constant money, a career record, etcetera. But individual loan providers usually focus much more about your residence method of and cost, your earnings, along with your down-payment (many personal lenders will need about fifteen% of your house’s well worth due to the fact an advance payment compared to only 5% out-of antique lenders).

Interest rates along with include higher having personal mortgages, which is why its best if you’re taking benefit of a private financial when you work at restoring their borrowing. Once you are into the a better lay borrowing from the bank-wise, you can look to the likelihood of refinancing which have a unique lender at the end of their title.

If you’re considering a personal mortgage, contact an experienced mortgage broker to from the procedure. A broker can check your document and you may see if an exclusive financial will be a good fit, hook you to your best lender, which help you understand your financial terms and conditions.

Canada’s mortgage acceptance criteria always tighten, it is therefore more complicated than ever before having Canadians to shop for its dream attributes. Luckily for us, private lenders occur all over Canada, plus they are prepared to assist people accessibility money they need to gain access to their next house. In the Chris Allard Mortgage Cluster, we are able to help you find a lender that has ready to performs to you, regardless of if you have been refused because of the larger banking institutions.

What’s an exclusive Home loan?

This basically means, a personal mortgage try home financing this is not stored from the a bank, credit partnership or mortgage lender. Rather, financing is loaned by the a installment loan Louisiane third party, like a corporate if you don’t an individual.

How do Personal Mortgage brokers Really works?

The new lending techniques with an exclusive financial is like new process of borrowing off a bank. You’ll be able to remain needed to fill in proof of income and you will borrowing from the bank recommendations in advance of you can easily obtain the money. Paying back a private mortgage is done thru monthly payments, exactly as you’d with your normal bank financial.

Why Choose an exclusive Mortgage?

Personal lenders inside Ottawa aren’t subject to an equivalent regulations given that banking institutions and do not need certainly to place you from same worry assessment. Generally, this means they might be simpler to be eligible for additionally the approval process is even more quickly.

Getting a personal Home loan

How you can see a personal financial for the Ottawa try from the handling a skilled large financial company who focuses primarily on so it urban area. A professional agent discover verified loan providers and you can negotiate from their principal amount to your payments and you may interest in your behalf.

Concerns

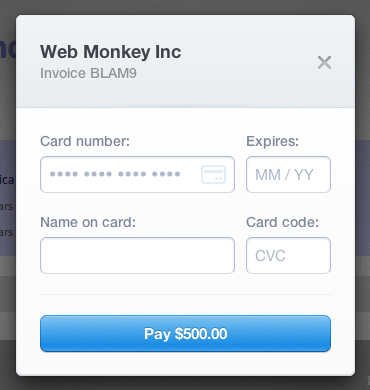

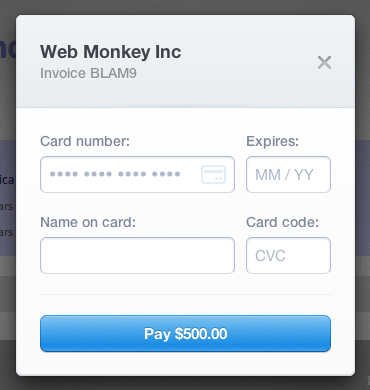

Fill in the design lower than along with your financial issues otherwise questions, and Chris promises to get back to you shortly!

Private Mortgage loans Imply More Liberty

Having times when banking companies are not able otherwise unwilling to lend currency for the mortgage, private loan providers is actually an alternative option for borrowers. In reality, a personal financial otherwise mortgage is the common option, based on your position.

Individual Mortgage loans Discussed

An exclusive financial try a preliminary-term mortgage acquired out of a private lender such an individual, organization, or a small group of buyers. These businesses can make their very own statutes and constraints when it comes to credit money and sometimes don’t use the same criteria while the banking institutions whenever giving mortgage applications.

As to why Look for a private Home loan?

Personal mortgage loans are often sought after by the borrowers that have bruised borrowing from the bank that are not qualified to receive a traditional mortgage toward finest pricing and terms and conditions out of a bank otherwise financial institution.

Individual lenders in addition to generally speaking offer a whole lot more easy installment terminology and so are so much more flexible within their terms if you are capital the loan.

There are various private loan providers into the Ottawa that will offer you a mortgage, despite a poor credit records. While the institutional lenders was stricter about their home loan underwriting, in addition to exactly who capable provide to help you, a lot of people that have bruised credit don’t realize they may be able rating a mortgage.

The fresh new rigid legislation having organization lenders are especially inconvenient for all of us with non-conventional incomes including provider experts, seasonal experts, and you can notice-working people.

Having private lenders, a home loan may be within your arrive at, no matter your history. Chris Allard offers possibilities, and private lenders simply take of several issues into consideration, also bizarre earnings and private record, just your credit rating.

Of many private loan providers range from the chance out-of a lesser rate immediately following your have demostrated a confident cost records, and may let rebuild and you may change your borrowing, delivering you a better rates just a few years in the mortgage!

In terms of bringing accepted to have a private financial, this course of action appears a little while various other as compared to old-fashioned bank mortgages.

Having old-fashioned home-based mortgage loans regarding a lender and other major financial intuition, lenders commonly heavily weighing things just like your credit score and you will borrowing history, constant money, a career record, etcetera. But individual loan providers usually focus much more about your residence method of and cost, your earnings, along with your down-payment (many personal lenders will need about fifteen% of your house’s well worth due to the fact an advance payment compared to only 5% out-of antique lenders).

Interest rates along with include higher having personal mortgages, which is why its best if you’re taking benefit of a private financial when you work at restoring their borrowing. Once you are into the a better lay borrowing from the bank-wise, you can look to the likelihood of refinancing which have a unique lender at the end of their title.

If you’re considering a personal mortgage, contact an experienced mortgage broker to from the procedure. A broker can check your document and you may see if an exclusive financial will be a good fit, hook you to your best lender, which help you understand your financial terms and conditions.

Canada’s mortgage acceptance criteria always tighten, it is therefore more complicated than ever before having Canadians to shop for its dream attributes. Luckily for us, private lenders occur all over Canada, plus they are prepared to assist people accessibility money they need to gain access to their next house. In the Chris Allard Mortgage Cluster, we are able to help you find a lender that has ready to performs to you, regardless of if you have been refused because of the larger banking institutions.

What’s an exclusive Home loan?

This basically means, a personal mortgage try home financing this is not stored from the a bank, credit partnership or mortgage lender. Rather, financing is loaned by the a installment loan Louisiane third party, like a corporate if you don’t an individual.

How do Personal Mortgage brokers Really works?

The new lending techniques with an exclusive financial is like new process of borrowing off a bank. You’ll be able to remain needed to fill in proof of income and you will borrowing from the bank recommendations in advance of you can easily obtain the money. Paying back a private mortgage is done thru monthly payments, exactly as you’d with your normal bank financial.

Why Choose an exclusive Mortgage?

Personal lenders inside Ottawa aren’t subject to an equivalent regulations given that banking institutions and do not need certainly to place you from same worry assessment. Generally, this means they might be simpler to be eligible for additionally the approval process is even more quickly.

Getting a personal Home loan

How you can see a personal financial for the Ottawa try from the handling a skilled large financial company who focuses primarily on so it urban area. A professional agent discover verified loan providers and you can negotiate from their principal amount to your payments and you may interest in your behalf.

Concerns

Fill in the design lower than along with your financial issues otherwise questions, and Chris promises to get back to you shortly!